Goods and Services Tax, abbreviated to GST, is a broad-based value-added tax in Singapore. It is levied on the import of goods, as well as nearly all supplies of goods and services. GST is comparable to the Value-Added Tax or VAT that is common in other countries.

On the 19th of February 2018, the Finance Minister of Singapore announced that GST will be imposed on imported digital services taking effect from the 1st of January 2020. The change is intended to ensure that local and overseas services are fairly treated in the tax system. For UpCloud users who are residents of Singapore, GST is applied to new payments starting from the 1st of February 2020.

Singapore businesses and GST

In Singapore, GST is levied on the import of goods and nearly all supplies of goods and services. All consumer users and unregistered businesses will have the GST of 8% added on top of their regular payments as required by Singapore’s tax law.

According to the Inland Revenue Authority of Singapore, businesses with taxable turnover exceeding $1 million must register for GST. Additionally, all other businesses may choose to voluntarily register for GST. Singapore residents are responsible for providing complete and accurate information to GST-registered overseas service providers so that they can determine whether Singapore GST is applicable.

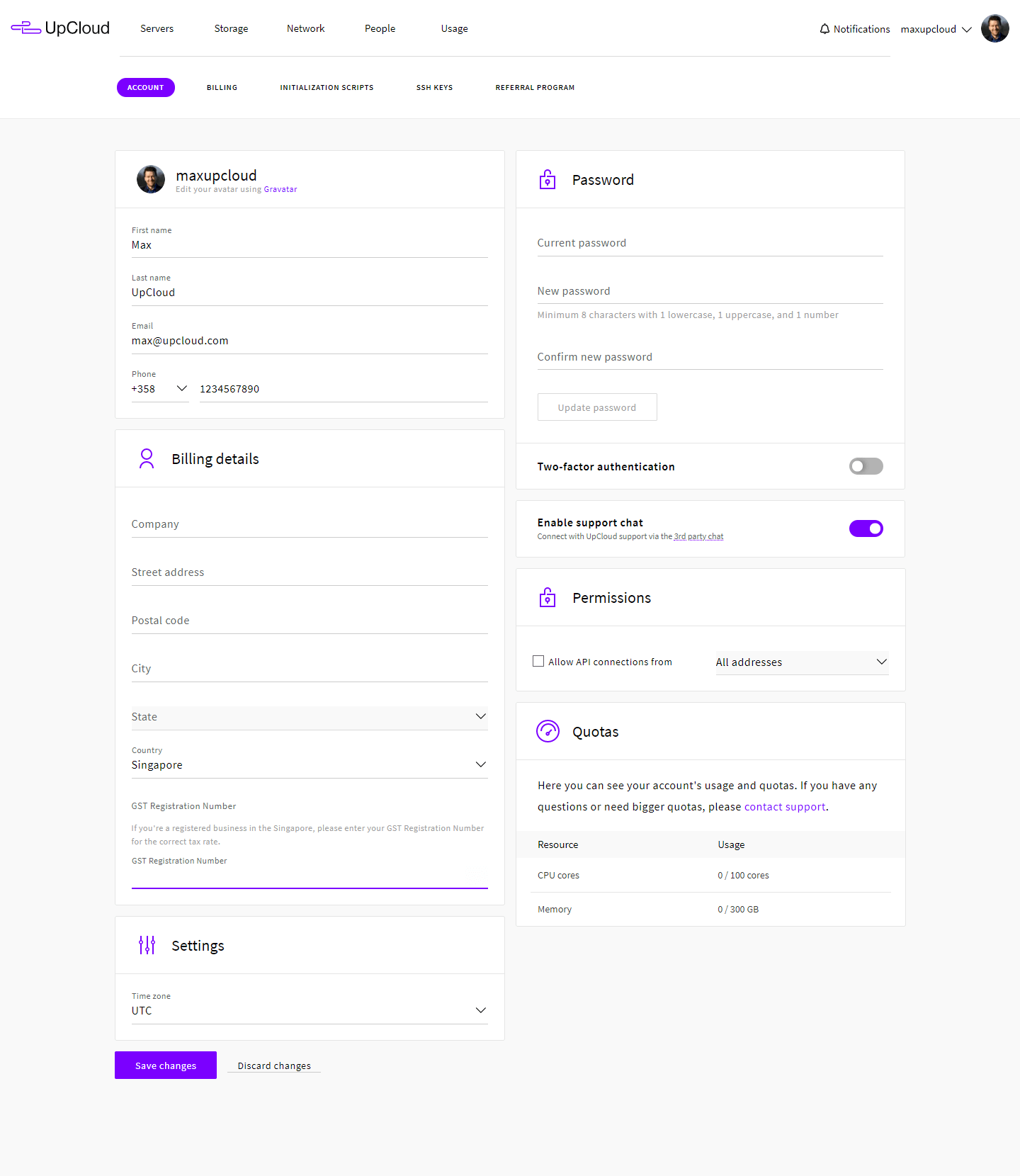

Adding your GST registration number

GST-registered businesses should add their GST registration number to their UpCloud account billing details. By including a valid registration number, you are eligible for GST-free payments.

Begin by going to your account section in the control panel.

In the Billing details, you can find the field for the GST registration number. Enter your GST registration number in the allotted text field.

When done, click the Save changes button at the bottom of the page to confirm.

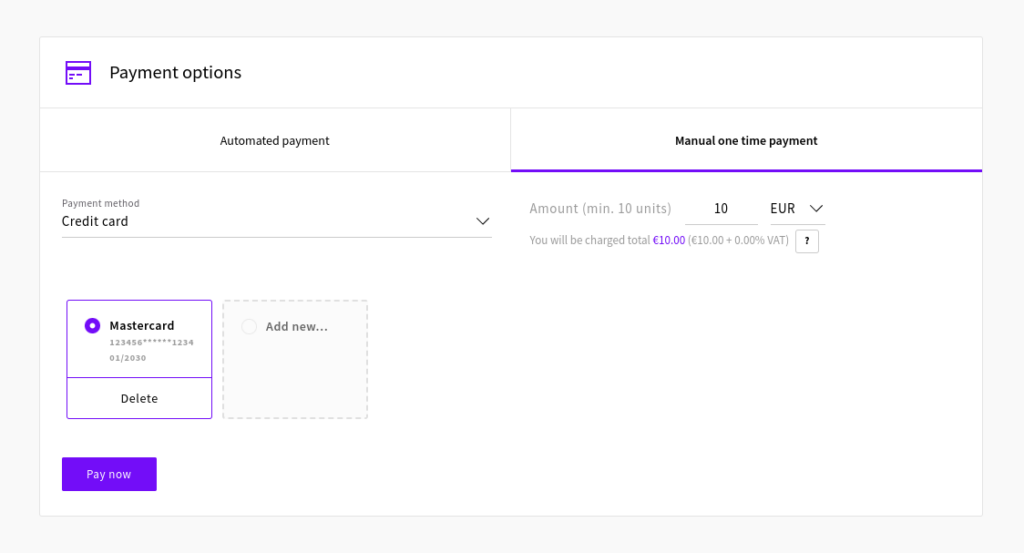

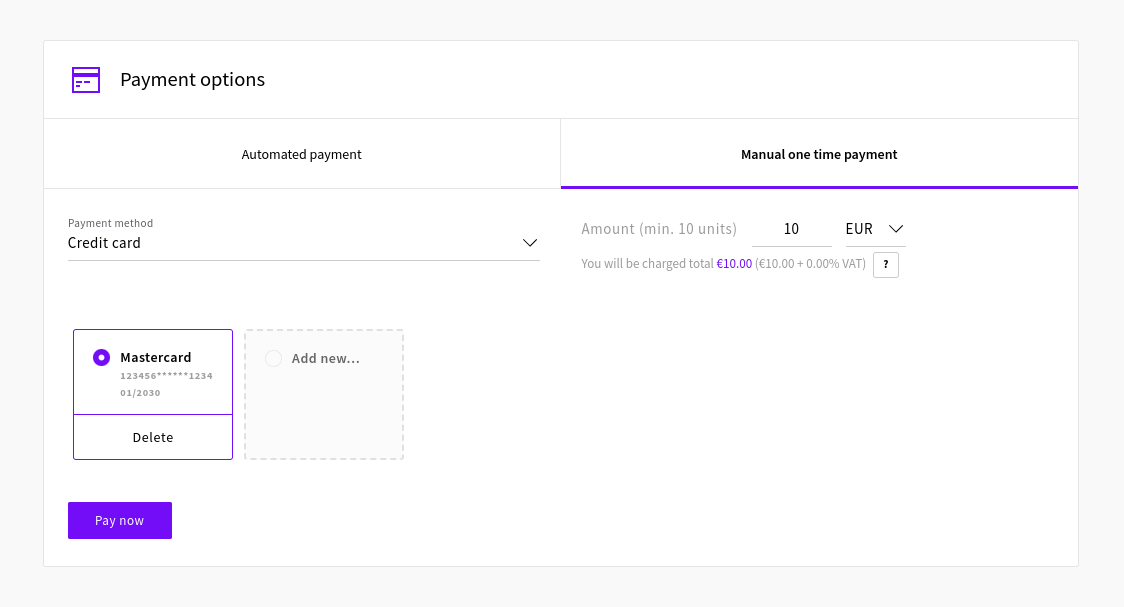

You can then verify that the GST number was successfully added by going to the Billing page at your Control Panel.

The amount to be charged will then show the price with the 0% tax rate.

vegha

Enjoyed reading the article above, really explains everything in detail, the article is very interesting and informative.